As part of the American Lamb Board Roadmap, the industry is encouraged to increase its use of value-based pricing to reward quality lambs. In theory, value-based pricing, or lambs sold on a formula or grid, should reward quality lambs at harvest and discount inferior lambs. Formula lambs are priced post-harvest according to a base price accompanied by premiums and discounts – often for yield grade, carcass weights and carcass yield.

In theory we expect to see use of formula trades and improved quality to go hand-inhand. However, the correlation is very unclear when it comes to U.S. experience. In the mid-2000s the portion of total federallyinspected harvest that was traded on formulas stagnated at about 40 percent, but then fell precipitously in 2010 to 20 percent by 2014. From 2005 to 2014, the percent of lambs receiving yield grades 2s and 3s (the more preferred yield grades) trended downward from about 79 percent in 2005 to 74 percent 2014.

Perhaps the current system perhaps isn’t living up to its potential: maybe it isn’t reducing risk, it isn’t cost-saving and it isn’t assuring packers and rewarding producers with improved quality.

In a 2007 study commission by the U.S. Department of Agriculture Packers and Stockyards Program (GIPSA) there wasn’t any statistical significant difference in the quality of lambs procured through formula pricing and cash procurement methods between 2002 and 2005. This is contrary to the presumption that the quality of lambs procured through cash methods is necessarily poorer than the quality of lambs procured through formula methods (GIPSA, 1/2007).

Perhaps the challenge is defining excellent lamb eating quality from live lamb characteristics. A recent Colorado State University (CSU) and Ohio State University (OSU) report concluded that “lamb quality is a moving target that means different things to the supply chain and sheep/lamb industry stakeholders,” (April 2015).

We can measure yield grade, but yield grades represent relative amounts of boneless trimmed lamb meat obtained from a lamb carcass. Yield grade does a good job tracking the excess fat problem in the lamb industry, but it is only half of the lamb eating satisfaction equation.

Quality grade, or the predicted palatability of the lamb, is also important. Most lambs in the U.S. that are graded, grade choice indicating less marbling than prime, but is still of high quality and juiciness. Maturity, or lamb age, is an important component of quality grading with younger lambs generally being more acceptable to consumers. The industry is currently taking old crop lambs to market and most of these are older than one year of age.

In January and February, the percent of lambs that graded choice was 93.6 percent compared to 94.0 percent a year ago. Perhaps more telling was that only 60 percent of commercial harvest was graded in January and February, down from 64 percent a year ago. In early 2015 there were nearly 18,000 fewer lambs that were not graded for one reason or another.

A recent study by CSU/OSU found that American consumers will pay more for a consistent, high quality eating satisfaction experience (April 2015). Would higher margins for retailers, food service purveyors, packers, fabricators, producers and feedlot owners warrant a disciplined, industry-wide effort to improve quality?

According to the CSU/OSU study, eating satisfaction was most likely to return a premium (72 percent) and product assurance of eating satisfaction (getting the same high-quality lamb meal after meal) received the highest willingness-to-pay premium at 19 percent (April 2015).

While 72 percent of survey respondent said they would pay for improved eating satisfaction, other credence attributes are also important to American consumers and can help add value to the industry. The CSU/ OSU report concluded that “while eating satisfaction is difficult to visually ascertain, retailers and foodservice representatives identified that credence attributes can be monetarily beneficial,” (April 2015).

Fifty-three percent of survey respondents including retailers and foodservice representatives said they would pay more for improved product appearance (fresh color, fat trim level, freshness), 53 percent said they would pay more for good sheep raising practices (grass-fed, humanely-raised), 52 percent said they would pay for locallyraised lamb, 48 percent they would pay more for nutrition/wholesomeness (safety and healthfulness) and 34 percent would pay for weight/size (consistency/uniformity of product cut weight/size).

To the industry’s credit, different markets exist for different sized lambs. One purveyor in the CSU/OSU study revealed that “We need to produce shoulder and legs with a small hot carcass weight, and the rack and loin from lambs with a large hot carcass weight,” (April 2015). A challenge is to match the right product from the right sheep with the right customer, and do this consistently.

“A disconnect exists on preferred size of lamb carcasses and cuts between sectors,” explained the CSU/OSU study (April 2015).

Unfortunately, national lamb industry data reported by USDA doesn’t reflect the smaller, successful markets that are booming across the country.

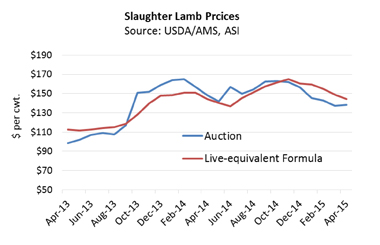

ASI explained that depressed slaughter lamb prices at auction, higher cold storage stocks and higher imports “justify this request,” (ASI Weekly, 4/2015). Slaughter lamb prices at auction were about $18 per hundredweight (cwt.) – or 11 percent — lower during the first trimester of 2015 compared to a year ago. At 36.8 million pounds, the amount of lamb and mutton in cold storage in March, 2015, was 5 percent higher from the previous month and 40 percent higher year-on-year. For perspective, that is nearly triple the level of 2008. In addition, the strength of the U.S. dollar is contributing to a higher volume of imported lamb and contributing to price pressure on the U.S. market. Lamb imports were 10-percent higher in the first quarter compared to a year ago.

ASI explained that depressed slaughter lamb prices at auction, higher cold storage stocks and higher imports “justify this request,” (ASI Weekly, 4/2015). Slaughter lamb prices at auction were about $18 per hundredweight (cwt.) – or 11 percent — lower during the first trimester of 2015 compared to a year ago. At 36.8 million pounds, the amount of lamb and mutton in cold storage in March, 2015, was 5 percent higher from the previous month and 40 percent higher year-on-year. For perspective, that is nearly triple the level of 2008. In addition, the strength of the U.S. dollar is contributing to a higher volume of imported lamb and contributing to price pressure on the U.S. market. Lamb imports were 10-percent higher in the first quarter compared to a year ago.