- February 2014

- President’s Notes

- Market Report

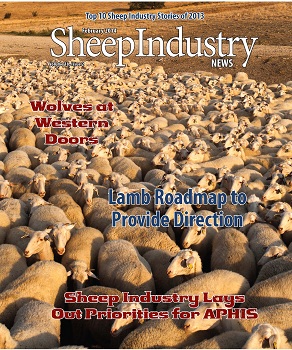

- American Lamb Industry Announces Final Roadmap

- Looking Back: Top 10 Sheep Stories of 2013

- Sheep to Shawl

- Sheep Growing Senator Weighs in on Idaho Wolf Debate

- Are Your Ewes Pregnant?

- Economist Sees Bumpy Years for U.S. Ag

- New Farm Bill May Bring Insurance Issues

- New Wool Yarn Mill Filling Niche

- College Wool Judging Teams Pick Up Skills Together at Belle Fourche Clinic

- ASI Offers Sheep Priorities to APHIS

- Utah Farm Bureau: States Can Manage Wolves

- Farmland Prices Rise, But How Long is Ride?

- Sheep Heritage Contributors

- Obituaries

Farmland Prices Rise, But How Long is Ride?

WASHINGTON – Farmland sales continue to climb, according to data released by national real estate and management firm Farmers National Company.

The company says it made $750 million worth of sales in 2013, compared to $640 million in 2012.

But with a softening commodities market – cash corn prices in the current marketing year will be down 36 percent from the previous, USDA forecast in a report – can climbing land prices continue to break records?

Farms continue to be profitable “despite lower commodity prices…due to reductions in fertilizer expenses of nearly 30 percent,” said Randy Dickhut, vice president of real estate operations at Farmers National. “This is prompting farm owners to continue buying premium land to expand their operations.”

Though economists at Purdue University predict fertilizer prices will remain low, some experts say that won’t be enough keep land values afloat should commodities continue their downward spiral.

Low interest rates have also slowed down price increases, though the outlook for those financial instruments may soon change. In a biannual Kansas State Agricultural Lender Survey in November, lending institutions indicated interest rates will increase in both the short and long term.

The lenders also said they expected land values to continue to increase for the next year – but ultimately fall between 2015 and 2017.